Tariffs and Emerging Markets

- The JSBF Report

- Sep 8, 2025

- 4 min read

Introduction

Tariffs are a common protective measure used by emerging markets to attain industrial self-sufficiency and economic growth. By taxing imported goods, governments hope to increase domestic production, create new industries, and reduce dependency on foreign goods. Despite its political appeal, this strategy has a complicated trade-off that impacts international relations, currency valuation, and foreign investment flows.

Over the recent decade, countries such as India have increased their tariffs significantly. According to the World Bank, India's average applicable tariff rose from 13% in 2014 to 18.3% in 2020, owing largely to its "Make in India" push. The goal was to increase manufacturing's GDP contribution from 16% to 25%, but by 2023, that percentage had remained at around 17% (World Bank, 2023).

Effect of Tariffs

Protectionist policies often discourage foreign direct investment (FDI), which is essential for economic growth. In general, investors look for open, stable markets with predictable regulations. According to the IMF 2023, emerging nations with strong trade openness receive 25% more FDI than those with greater tariff barriers suggesting that while tariffs may provide short-term protection, they risk harming long-term capital inflows required for innovation, employment, and technological transfer.

Tariffs can also put pressure on currency dynamics. High import taxes may cause increase in input prices leading domestic prices to increase, resulting in inflation. Central banks may respond by enacting stricter monetary policies, which, depending on market confidence and capital flows, may either strengthen or destabilise the local currency.

Tariff escalation frequently causes diplomatic friction. For example, when India imposed tariffs on US almonds and apples in response to steel tariffs, the US responded by delaying key trade deals and revoking India's GSP (Generalised System of Preferences) status, affecting $5.6 billion in Indian exports each year (Office of the United States Trade Representative, 2022).

Tariffs can be an effective short-term tool for safeguarding domestic industries, but their use needs to be carefully considered. Maintaining an open, investor-friendly, and globally integrated trade environment while assisting local businesses is necessary for sustainable economic development in emerging markets.

Current Situation

Tariffs have recently taken centre stage in a world increasingly shaped by trade tensions and shifting geopolitical alliances, with significant ramifications for emerging markets. Tariffs are frequently used by developing nations to safeguard their own industries, but current global trends—particularly those started by the United States—are making the risks and uncertainties they already face even worse.

Although the United States has long supported free trade, under Donald Trump's leadership, the paradigm changed. Citing unfair trade practices, intellectual property theft, and the trade deficit between the United States and China, Trump began a broad tariff campaign in 2018–2019, imposing duties of up to 25% on $360 billion worth of Chinese imports. In addition, he placed tariffs on EU goods and briefly contemplated imposing duties on steel and pharmaceuticals from India.

As he runs for re-election in 2024–2025, Trump has now suggested even more stringent tariffs, up to 10% on all imports and even 60% on Chinese goods. His justification? to "protect national security," lessen reliance on China, and revive American manufacturing. However, many economists contend that this protectionist approach is misplaced.

Economic Perspective

Tariffs act as a kind of consumer tax. 92% of the costs of the 2018–2019 tariffs were borne by American importers and consumers, according to research from the Peterson Institute for International Economics. Supply chains were broken, prices increased, and U.S. exporters had to deal with retaliatory tariffs from the EU and China.

This has had a knock-on effect on emerging markets. Export orders have drastically decreased for nations that are part of supply chains that are centred on China or that are headed to the United States. Consider Mexico or Vietnam, which experienced a brief boost from the relocation of their supply chains but are currently more volatile as a result of the uncertainty surrounding global tariffs.

Recession Fears

The market's response to the renewed threat of tariffs is evident. When the trade war grew more intense in August 2019, the Dow Jones fell 800 points in a single day, which at the time was the fourth-largest point drop in history. The yield curve inverted (10-year Treasury yields fell below 2-year yields), a traditional recession indicator, as the U.S. bond market also reacted.

Similar market tremors are reemerging in 2025. The S&P 500 has seen increased volatility as a result of Trump's suggestion of a blanket tariff, and investors are turning to safe-haven assets in droves. Amid concerns about a recession, 10-year U.S. Treasury yields fell from 4.3% to 3.9% in March 2025, indicating a decline in investor confidence.

Impact on Emerging Markets

The collateral damage frequently falls on emerging economies. Their exports decline as international trade slows. Declining capital inflows cause currencies to weaken, which drives up import prices and causes inflation. The central banks of South Africa, Brazil, and Indonesia are balancing trying to keep inflation under control without slowing down their already slow growth.

For instance, Trump's tariff proposals caused risk-off behaviour, which led to a 12% increase in foreign portfolio outflows from India in Q1 2025. In just six weeks, the rupee lost 3.7% of its value in relation to the US dollar.

Impact on Future

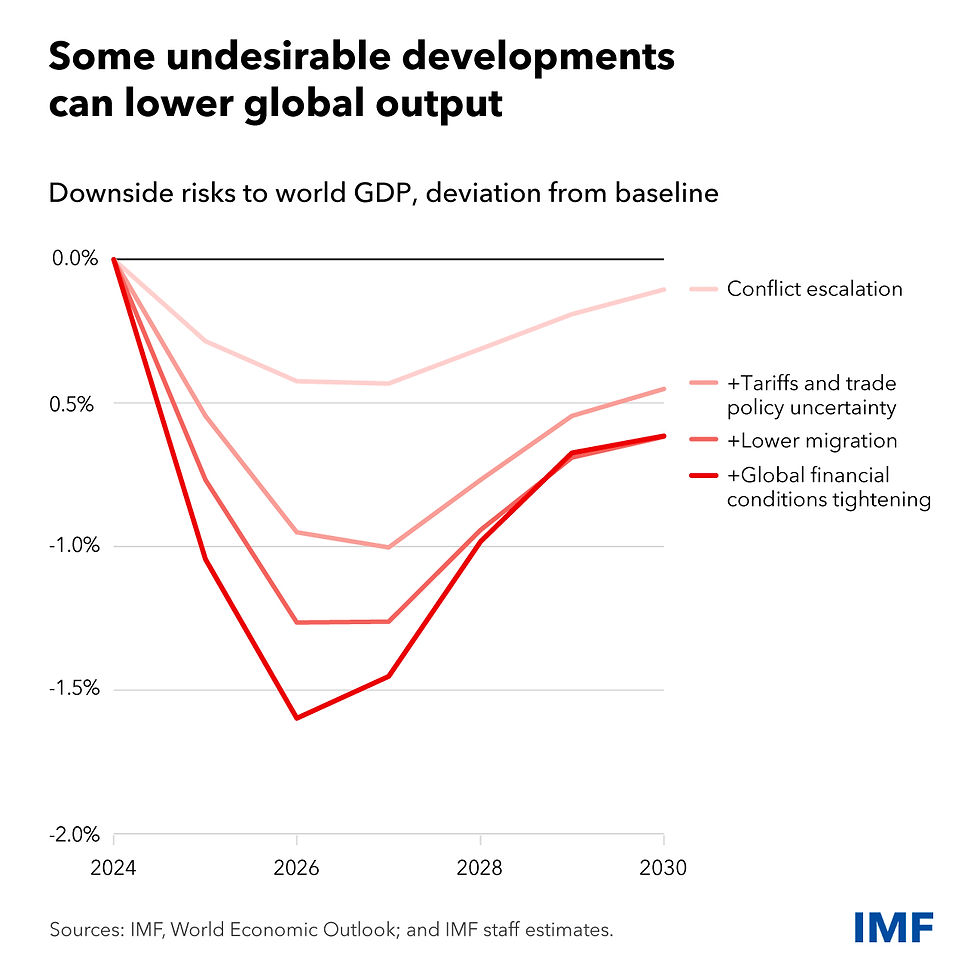

The world economy may be on the verge of slowing down if these tariff threats come to pass. According to IMF estimates, a full-scale tariff war could reduce global GDP growth by 0.5% to 0.7%. This could result in weaker fiscal positions, less foreign direct investment, and greater inequality for emerging markets that depend on export-driven growth and international capital inflows.

Tariffs should be used strategically, transparently, cooperatively, and with an emphasis on long-term competitiveness rather than short-term nationalism. This is the answer, not their complete elimination.

Conclusion

Tariffs are a double-edged sword, especially when applied in the context of growing populism and protectionism. In order to successfully navigate this terrain, emerging markets must strike a careful balance between macroeconomic resilience and diplomatic nimbleness in the face of erratic international headwinds, as well as strategic protectionism at home.

Comments